Executive Summary

Truist Banking App Updates Failing To Resolve Issues As US Bank Continues To Lead Global Ranking

The Truist Banking App Engaged Customer Score™ (ECS) has started a slide from its high of 3.84 in Sept, to 3.18 in November. Over the 6 months preceding this drop Truist had made good headway, consistently lifting its ECS each month from its low point of 2.25 in Feb 2022.

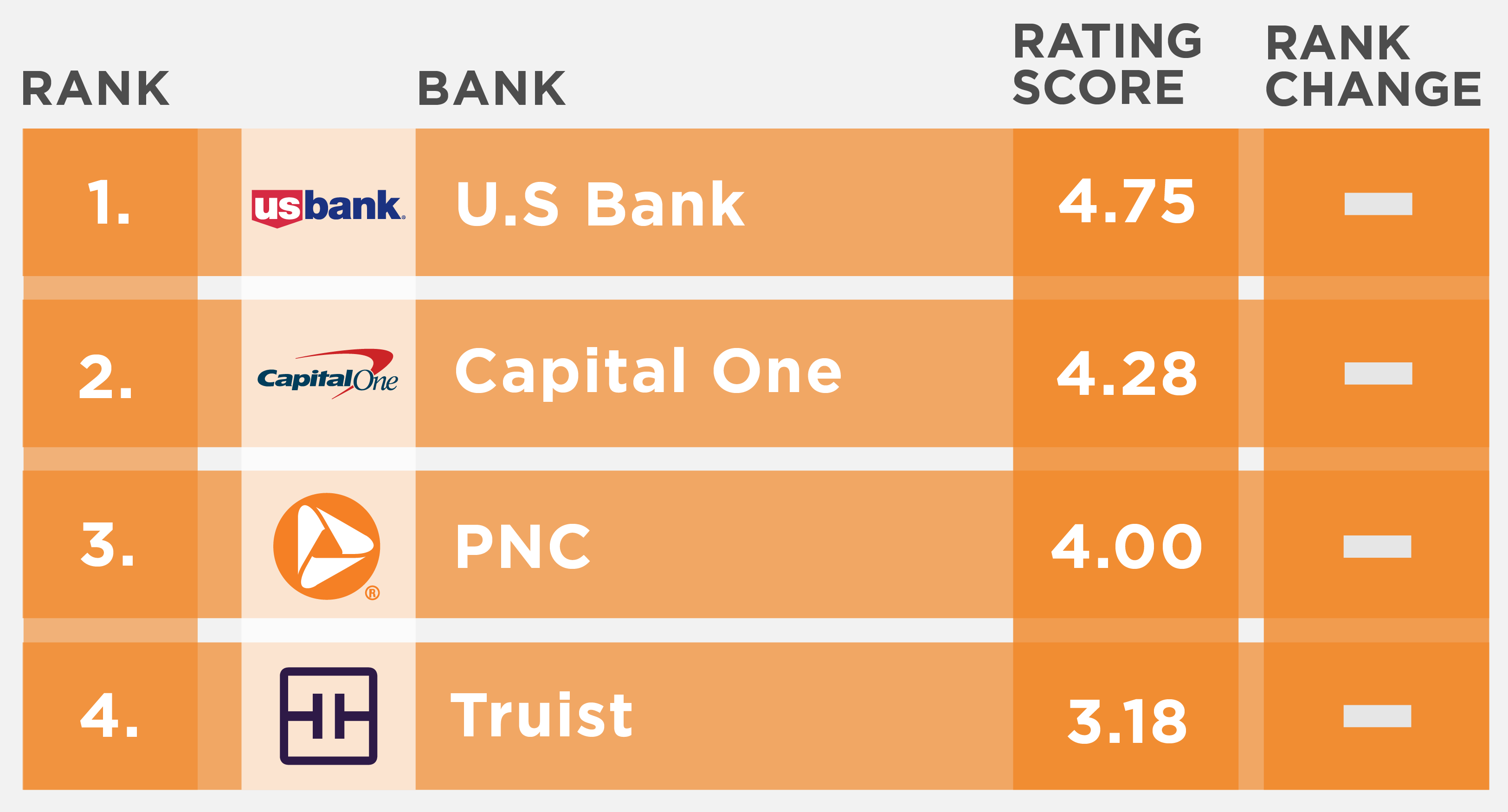

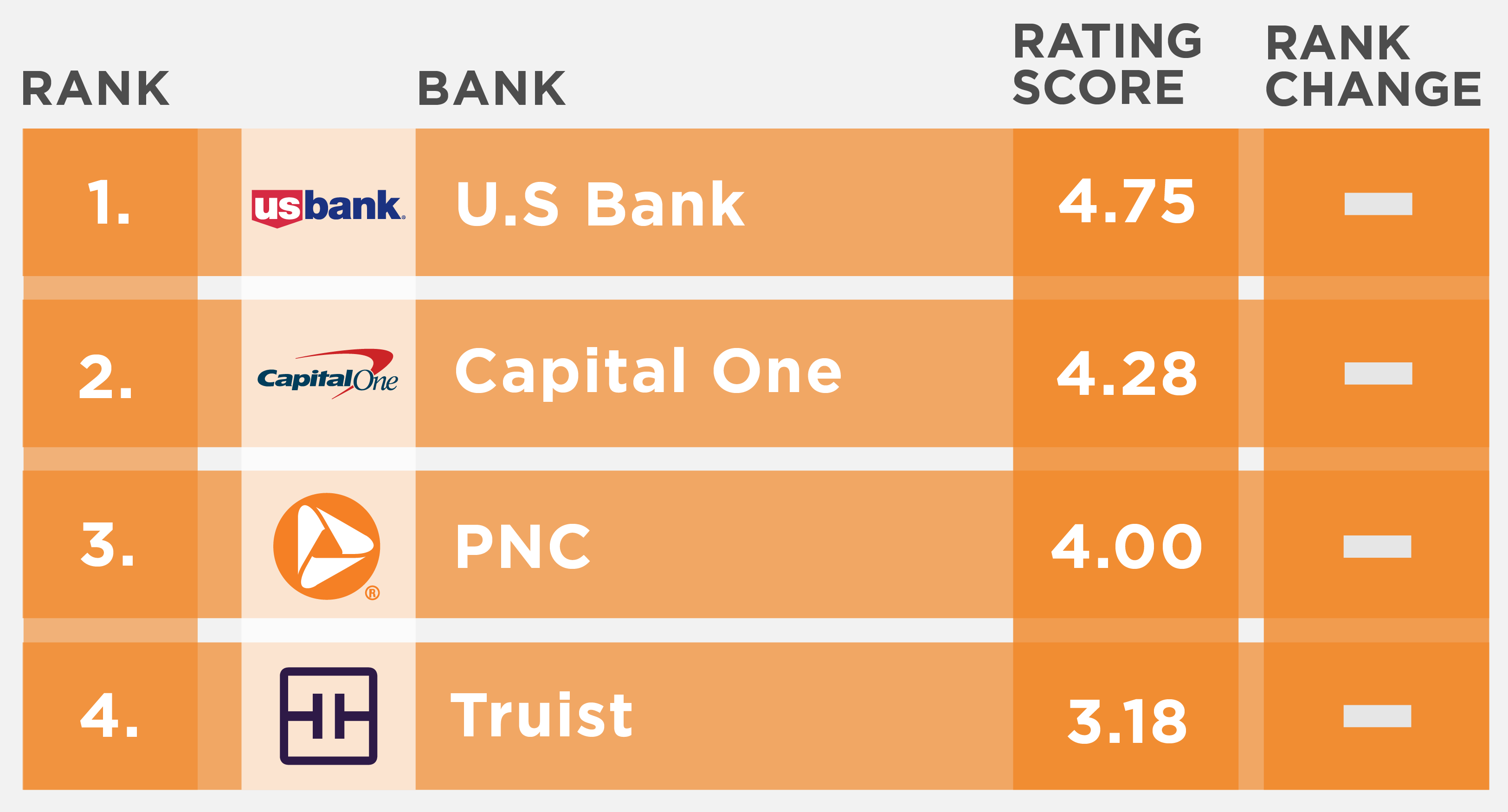

US Tier 1 Banking App Engaged Customer Score Rankings Nov 2022

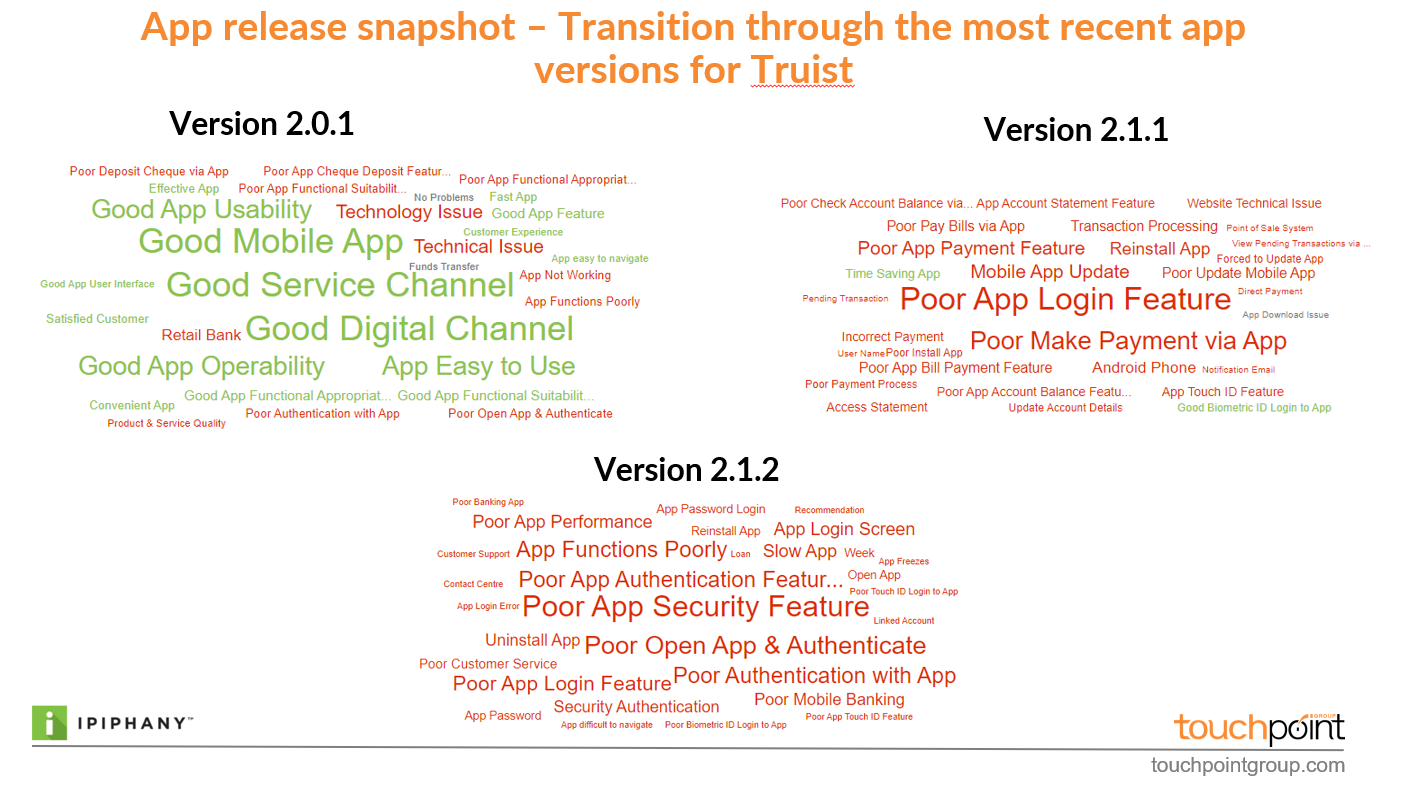

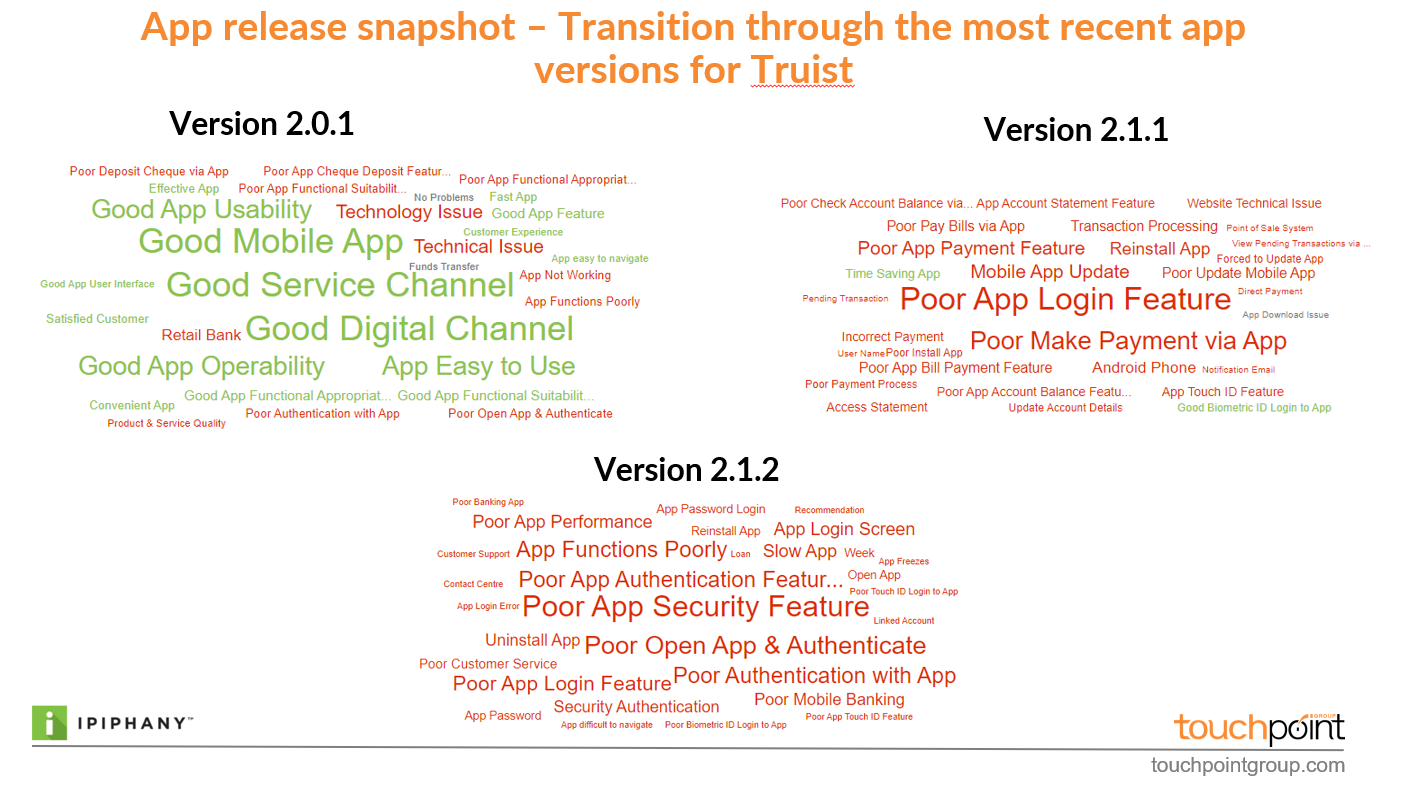

Version release 2.1.1 was where the troubles began in October with negative comments from app users complaining about the Zelle payments and bill payments, in general, rising significantly. Version 2.1.2 was quickly released, which is a good sign the Truist team was aware of issues however the complaints are still coming through, signifying the issues have yet to be isolated and resolved. The use of Touchpoint Groups Ipiphany analytics software to track and monitor public feedback in the Google Play and iOS App stores has been used to identify and isolate these issues and release versions they relate to.

Truist Banking App Customer Feedback Themes Nov 2022

While this slide has seen two drops in two months, the consistent improvements by Truist before these issues, and the speed at which updates have been released, give us hope that this may be a blip and Truist will recover quickly.

Meanwhile, U.S, Bank continues to impress with an Engaged Customer Score of 4.75. U.S. bank has consistently been the number one banking app globally based on the unsolicited public customer feedback that makes up the Engaged Customer Score ratings. A commitment to excellence in the core areas of Security, Usability, Reliability and Functionality allow all features to shine.

Glenn Marvin, Chief Revenue Officer at Touchpoint Group, states, “The Bank to watch over the coming months is PNC. They have been the quiet achievers in 2022 and have now hit an Engaged Customer Score of 4.0. If they continue this path of consistent improvements in the core functions and journeys, they could overtake Citi Bank in 2023 and be in contention to fight for the top spot”

Touchpoint Group is a customer intelligence company utilizing advanced AI and natural language understanding in its proprietary analytics platform to analyze over a million banking app reviews each year in their global ECS index.

Touchpoint Group processes customer feedback data captured using internal customer experience platforms and sources. Data is updated daily, with insights available to identify issues for Operational teams, monthly reporting for Leadership teams, and a Mobile Customer Experience Analytics (MCXA) report published quarterly for Executive leaders to benchmark performance by category and against the best in banking app performance.

Video Transcript From Insights Session

00:00:05 - Glenn: Hello everybody and welcome to another Touchpoint Group Banking Insight Session and we're looking at the US Tier 1 Banks for their November performance. And the focus this month is a little bit on Truist, who have in general had a stellar year taking what was quite a low Engaged Customer Score ranking in and ending up in quite a strong position, Tony, but they've had a little bit of a downward blip haven't they?

00:00:35 - Tony: They definitely had, Glenn. So I'll jump straight in.

We are looking at U.S Bank, Capital One, PNC and Truist across our Tier ones.

But I'll jump straight in and look at a normal perspective to start with. And let's have a look at the scores.

First of all, we're seeing Capital One and U.S Bank actually doing very well, they're actually sitting there above 4.25 most of the time and they're doing very well and they're like the gold standard for a lot of this.

One of the other ones we look at continuously is PNC, and we can see there, they dropped away in February-March this year below 3. But they've made a nice gradual incline up until the point now where they're sitting above 4 and if they've hit that barrier, which is normal, we can hit above 4 it's really difficult to get beyond that, you need to-- it's obviously incremental small things to get yourself up to that level.

They can reasonably soon begin to compete with Capital One in this sense here.

One of the things we'll look at today though is Truist and the obviously BB&T and SunTrust, the combination of those, the app originally was sitting down below 2.25 so, not too good. But, they've done a great job, they've actually built that up across time and it's a gradual and nice increase.

What we have to look at though, is a bit of a blip we're seeing here that there's a bit of turnaround in October and November and it's bringing them back to levels they were in June. They need to be aware of what's going on here so that then they can obviousl act on feedback and stop this declining further.

Let's just jump in and have a look at the App Release Cycle. Looking at the Truist release cycle.

Now it's fairly neat, you'd like to see these as fairly neat and consistent as one as a new one comes in. Say this one here, version 1.7 you expect version 1.6 to drop away. So that's great, they're doing a nice release cycle across the year and we can see the version 2.0.1 has also jumped up and the previous versions dropped away you want to see that. We've seen it with others, though this isn't normal, we see some others who actually have multiple versions out at the same time, causing inconsistency in the experience for customers. But I want to have a look at- this is across the whole year but, I want to focus just on the past few months because that's where that drop has occurred. Let's have a look at what's happened there. It is he last two months of October and November where things have dropped away. And we can see here that version 2.1 is sitting there, that dropped away. So what we're seeing here is I'd say the version 2.1.1 and this more recent version into November, 2.1.2 is where those issues are occurring, and we can see the drop away in-- It's a nice release as 2.1.1 is moving out of the way and the other one appears, which is great, you don't have too many versions floating around at the same time. But we do see that version 2.0.1 is actually still floating around a bit across time. Very, you know, not everyone's updating as they should in here as well. What we should do though is have a look at what's causing these issues across here. So, first of all, let's have a look at version 2.1 Let's have a look here on the right.

Now, a very quick way of looking at this is looking at from this perspective where we will get it from a concept Cloud so look at sort of how does this look from a perspective overall? What's the theme coming through?

We can see a reasonable amount of green so they were doing well that really high point three months ago.

But, we can see a few issues that can still pick up on. Things like push notifications, biometric ID and a few other things like viewing transactions and things like that are causing issues for some customers. But, overall, fairly good that sort of green haze coming through here.

Let's have a look though and move forward and look at this 2.1.1 so the next release. But what's happened there? What's the view, what's the perspective coming through there? So, very quickly you can see the difference, you can see there's less green, it's mostly red.

Suddenly we've got also this thing around Poor Moving Money via the App, so making payments. There's clearly a payment issues coming through and the payment feature is an issue there. What I can even do here is actually jump in here. Let's have a look at these only a handful of people here because it's only for one month. What I can do is have a look and see what are these big issues coming through;

Problems using Zelle is coming up. There's something about trying to submit a payment but it says "something about a signature external value" as a customer doesn't know what that's about. And also they're... it says "have been enrolled in Zelle but it won't let me use it" and says "I have to enroll" so this issue is going on with Zelle differently. So "paying bills is a hassle", "paying bill's horrible" so this has obviously jumped up recently it's standing out in the most recent month. So, let's-- we've had a look at that version 2.1.1 the most recent one though we've had a further decline. Let's have a look at what's happening inside that. So again, I'll have a look at it from this broad perspective, so we can just have a helicopter view of what's going on. So, this time around it's even worse than it was for this yellow version here 2.1.1, there's no green at all. But what's coming out now it's not about the payment features, it's about Security and Login so it's probably a double whammy. It's all those payment things aren't working as well but also the Security and Login issues are jumping out as well.

So clearly there's been a few things going on, and I think obviously, Truist needs to work on this to actually fix this for the next version, but from a broad perspective fix the security and fix that the payment issues with Zelle and some other components and they can bring themselves back up to that increase they were doing across time. So, great job for Truist overall, but there's some issues they need to address right now. So, thank you, Glenn.

00:06:55 - Glenn: Yeah, interesting how it's -supposedly- just so simple to isolate those couple of things that are dragging it down that if they focus their attention on over that next release, should be right back up there.