Reporting Frameworks in Ipiphany

In the latest Touchpoint Group insights session, we focused on covering key aspects of Ipiphany, our proprietary AI text analytics platform designed to transform open-ended customer feedback into actionable insights.

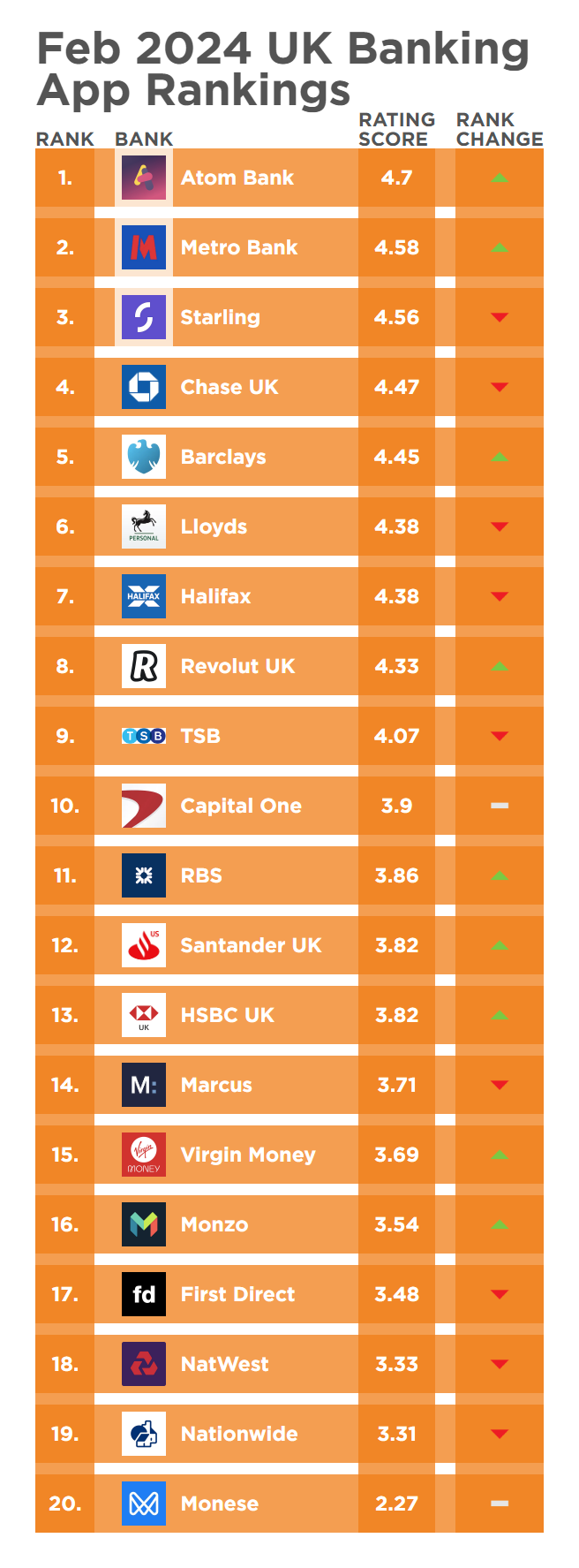

February 2024 UK Banking App Rankings and Insights Session

In our latest dive into the UK banking app market for February 2024, we've uncovered intriguing developments that shed light on the performance of key players. Led by Yazad Kakaria, Global Head of AI Analytics and CX Strategy at Touchpoint Group, we delved into the nuances of user experiences across major financial institutions.

Here's a breakdown of our findings:

Market Analysis: Identifying the Main Players

We closely monitored 20 banks in the UK, focusing on their mobile banking app performance. Five leading players stood out for our analysis: Lloyds, Santander, Chase, Barclays, and Capital One. Our insights draw from a comprehensive dataset sourced from Google Play and the App Store, comprising user reviews and ratings.

Engaged Customer Score: Deciphering User Sentiments

At the heart of our analysis lies the Engaged Customer Score, a metric ranging from one to five stars. This score reflects user sentiments gleaned from reviews accompanied by explanatory comments. Examining the trajectory of each bank's performance, we observed notable shifts in user satisfaction over time.

Performance Trends: Unraveling Dynamics

Historically a frontrunner, Lloyds experienced a marginal performance decline in early 2024. Conversely, Chase surged ahead, surpassing Lloyds in recent months to claim the market leadership position. Meanwhile, Barclays demonstrated resilience despite a sharp dip in March 2023, maintaining a steady performance since November 2023. Capital One witnessed fluctuations, with a gradual decline in performance, punctuated by occasional upswings. Though trailing in performance, Santander showed signs of improvement following a slump in late 2023.

Ipiphany, Touchpoint Groups AI-powered platform was used to illuminate Capital One's pain points within its user experience landscape. Key pain points identified within Capital One's app experience include:

Reliability and Stability Issues: Users report instances of app crashes, sluggish performance, and intermittent service disruptions, leading to frustration and dissatisfaction.

Authentication Challenges: Users encounter difficulties in the authentication process, including login errors and authentication failures, hindering access to essential banking services.

Usability Concerns: Interface design and navigation complexities detract from the user experience, resulting in confusion and inefficiencies in app usage.

Feature Limitations: Users express dissatisfaction with the lack of advanced features and functionalities, yearning for enhanced capabilities to meet their evolving banking needs.

By leveraging data-driven insights and strategic guidance, Capital One can formulate targeted interventions aimed at mitigating user grievances and enhancing the overall app experience. Prioritising enhancements in reliability, authentication, usability, and feature richness will be instrumental in solidifying Capital One's position and fostering sustained growth amidst intensifying competition.

Benchmarking Against Industry Leaders: Gaining Perspective

Benchmarking against industry leaders like Chase illuminates the gaps in performance for other players. A comparative analysis highlights disparities in user experience, empowering banks to prioritise areas for enhancement. By leveraging insights from Ipiphany, banks can align their strategies to bridge these gaps and enhance their digital offerings.

The Power of Data-driven Insights: Driving Strategic Decisions

Ipiphany's holistic approach equips our clients with actionable insights to drive strategic decisions. By harnessing the rich repository of app review data,at detail, banks can steer their digital transformation initiatives with precision. Touchpoint Group's turnkey solution for banking app insights, streamlines the process, enabling clients to focus on implementing the right actions based on their customer insights.

Conclusion: Navigating the Evolving Landscape

Understanding user sentiments is paramount for banks. Ipiphany's robust analytics framework empowers stakeholders with invaluable insights, paving the way for informed decision-making and continuous improvement. As we navigate the intricacies of the UK banking app market, Touchpoint Group remains a trusted ally in deciphering user experiences and shaping the future of digital banking.

For institutions seeking to elevate their digital offerings and stay ahead of the curve, Ipiphany stands ready to unlock the full potential of user data. Contact us today to embark on a transformative journey towards enhanced user satisfaction and sustainable growth.

Transcript

00:05 - Glenn Marvin: Hello, everybody, and welcome back to another Banking App Insights Session. We are looking at the UK market for February 2024. And as usual now, I have Yazad Karkaria with me, the Global Head of AI Analytics and CX Strategy. So, Yazad, What are some of the interesting findings that you have for us this month around the UK market?

00:30 - Yazad Karkaria: Thanks Glenn. We are tracking about 20 financial institutions and banks in the UK, the mobile banking app performance over there, and right now on my screen, you have about five main players in the market over there that we'll be analysing. We have Lloyds, Santander, Chase, Barclays and Capital One. So, right now, the numbers that we see on the screen are related to the Engaged Customer Score. So I'll take a moment and explain what this means.

We take the data from Google Play and App Store, and we take all those reviews which have a rating, along with a comment that explains why users have given a certain rating. This data set is extremely important as it gives us an understanding in terms of why certain app users are happy with some of the banks, whereas others are not so happy. So right now, we are looking at this particular data set, and the score can be in the range of 1 to 5 stars, depending on what the users have given. So, let's start with Lloyds.

We can see, we are looking at the data since Jan 2023. So, over the last 12 to 14 months, Lloyds has been really a strong performer and the leader throughout 2023. But interestingly, as we can see over here in the last couple of months, things have changed a little. So, the performance of Lloyds has marginally dropped in the last couple of months, that's Jan and Feb 2024. But at the same time, we have Chase, who started off the year 2023 at a much lower Engaged Customer Score than what Lloyds had at that point. But in the recent months, they have performed really well and they have actually overtaken Lloyds in the last few months, as we can see. Out of this set that we are looking at, they are currently the market leaders.

The next one that we have is Barclays. So Barclays also started off at a slightly lower range compared to Lloyds. But we can see that Barclays also had a drop in March 2023, a very sharp drop, but they did manage to recover from there and since November 2023, they have been consistently performing quite strongly, as we can see over here.

Then we have Capital One over here, which started off the year at a very similar note as Barclays. They had a very similar score. But in the recent months, in the second half of 2023, their performance has gradually declined, though they had a good month in December, but again, we are seeing a drop in their performance. And the last bank that we are reviewing today is Santander over here. Santander has been quite interesting. Their performance has always been in a lower range compared to others, even throughout 2023, as we can see, only Barclays was sometimes below their performance, as we can see over here. But the interesting thing here is that in November 2023, Santander performance dropped very, very sharply, and it continued to be in that lower range in December. But in January and February 24, we are seeing a partial recovery over here. So, in today's session, this is what we'll be focusing on. We will be focusing on understanding what has improved amongst Santander mobile app users.

03:48 - Glenn: Great. and how does that recovery translate in terms of the changes in user experience?

03:57 - Yazad: Right, Glenn. In order to understand this, we will be using our AI powered text analytics platform called Ipiphany, and we have developed a special framework to understand mobile banking app user experience by analysing over a million user comments every year. So, we've developed this framework in consultation with our internal experts and the clients that we work with. For any mobile banking app to perform well, it needs to do well on these four Foundational Pillars, which is Authentication, Design and UI, Reliability and Stability and Features and Functionality. So these are the four core areas that we track on an ongoing basis for each of the banks that we monitor, and within each one of these, we have a lot of detail that we can dive deeper into. We have a lot of subtopics which individually give us how the app is performing on each of these different areas. So, we'll be using this framework to understand Santander's performance.

On my screen right now, Glenn, we have Santander's performance across December, January and February. So, these different months are represented by the different colours that we have over here. In December, we can see that the average score, which is the Engaged Customer Score for Santander, was 3.4. It further improved to 3.6 in January, and then in February, we saw a further improvement when the score touched 3.8. Now, what we will be doing is we'll be using our Foundational Pillars to understand what has changed for users over a period of these three months. So, coming to the first pillar, which is Reliability and Stability over here in December, when the score was in the lower range, we can see that about 26.7% of the users face Reliability and Stability related issues. The good news for Santander users is though that this is gradually declining. So, in the month of Feb it's come down to 21.6. That's a movement in the positive direction. In terms of Authentication, about 7% users had reported Authentication related problems in the month of December, which then increased to about 9.6. And then again, this has come under control to some extent in Feb when it's chopped to 5.8.

In terms of Design in UI and Features and Functionality, we don't see much change over there, which tells us that user experience has more or less been similar across these three months on these main parameters. The interesting one over here though is Reliability and Stability. We can see that these pain points over here have dropped, which is good news. But the other important thing is that we just don't stop over here by looking at how these topics are moving.

What we can actually do, Glenn, is we can dive deeper into each topic and see what's happening. So when I click on Reliability and Stability over here, what Ipiphany has done is that it's opened up this screen on the right hand side, which then allows me to understand what are the main areas or different aspects of experience that customers are talking within this topic. So, within Reliability and Stability, we can see customers talking about Login Issues, App Performance related issues, App Update Problems, Access to Banking Services and Customer Support related feedback.

So, this summary is actually given to us by ChatGPT. We've done an integration with ChatGPT where this data gets analysed within ChatGPT and it throws up a descriptive summary that users can directly use. Earlier, this used to be done manually, but this is one of the new product development features that we have recently implemented.

Also, what we can do is we can interact with this data in a number of ways. So, I can look at the dynamic word cloud which tells me what are the key themes coming up within Reliability and Stability related issues and then finally I can dive deeper into the actual user comments. So, these are the actual comments that users of Santander have shared, and these have further got categorised into these multiple pillars, as we can see over here. Here we have customers talking about 'Login issues', 'quick balance not working', 'the app being slow', etc. There's a lot of detail that we can dig into after looking at the results at an overall level, and it just doesn't stop at that. Right now we are looking at our four Foundational Pillars to understand this improvement. But what we can also do is we can look at the subtopics over here, which give us a further detailed level of granularity. So, here now we can look at Technical Issues, Login Errors, Update Related Feedback, which has also moved positively as fewer issues have been coming up. Customers talking about the app, difficult to use, and so on. So, there's a lot of detail over here.

08:43 - Glenn: Yeah, that really is, and in looking at that, the improvements look good, but how close are they in reality to leaders like Chase?

08:53 - Yazad: Sure, that's a very valid point. So, yes, we did see that Santander results have marginally improved. But let's take a look over here on this slide. We are looking at the Feb result over here and comparing Santander with Chase, and let's look at the differences in user experiences over here. Chase had an Engaged Customer Score of 4.5, which is in a much higher range than Santander, which is at 3.8 and when we look at our Foundational Pillars and compare the pain points, we can straightaway see that the incidence of Reliability and Stability related issues among Santander users is almost twice as much as what we see in case of Chase.

Similarly, Authentication related issues are about three times of what Chase users would normally experience. There are some marginal differences even in Design and UI and Features and Functionality. But here on the four Foundational Pillars, we can very clearly see what the gaps are. And this is one of the main areas which our clients love, where they can actually see how far they are behind competition and what are the main elements of the app that they need to fix in order to make up this gap and come at a similar score as them. And similarly, Glenn, over here, we can get into a lot of details, so, we are looking at the Foundational Pillars, but the pain points will actually explain to me these differences at an overall level across multiple different topics that we are tracking.

10:19 - Glenn: Such a great way of benchmarking, and I love how you can put yourself side by side against a market leader to identify the areas that you can prioritise. It's fascinating stuff.

10:36 - Yazad: Yes, indeed, Glenn. In fact, the app reviews data is very sensitive to changes in user experience, and it's a rich source of insights about what users actually feel about the app. Our clients have used our offering to improve their digital experiences using Ipiphany. And the beauty of this solution, actually, is that it's a turnkey solution where we manage the data, we generate the insights and do the reporting for our clients, who can then focus on driving these findings internally at a strategic and a tactical level.

11:03 - Glenn: Yeah, absolutely. Great insights yet again. Yazad, I really appreciate the time, the effort, and the insights that not only you put into this, but the entire engineering team behind Ipiphany. And if you want to have a look at your bank, the app performance compared to one of your market competitors, feel free to sing out, and we can tee something up for you.