TD (Toronto-Dominion) Bank is Canadian-based, with over 26 million customers across the US and Canada. By driving customer-focused improvements to their digital banking offering, they’ve been able to improve and maintain their top score across a number of key digital customer experience, engagement, and adoption categories, as well as effortlessly managing the profound shift to digital banking as a result of the COVID-19 pandemic.

TD Bank was able to leverage Touchpoint Group’s AI text analytics tool, Ipiphany, through their research partner Novantas. They used Ipiphany to supplement their analysis of quantitative average score data with a detailed investigation of review comments, captured in the moment by engaged customers. TD has already demonstrated their dedication to continuously improving their offering for customers, and with a dedicated approach to understanding and acting on customer feedback, as well as a detailed investigation into competitors to produce accurate and useful benchmarking, it’s clear to see why they are rated consistently higher than the market on key consumer differentiators.

Understanding TD Bank’s rating by key topics

With a focus on exploring all avenues, TD Bank chose to include a quantitative as well as a qualitative approach to understanding their customer feedback. They used several sources to achieve a baseline understanding of score and app usage, and supplemented this by using Touchpoint Ipiphany to delve deeper into the individual topics driving scores.

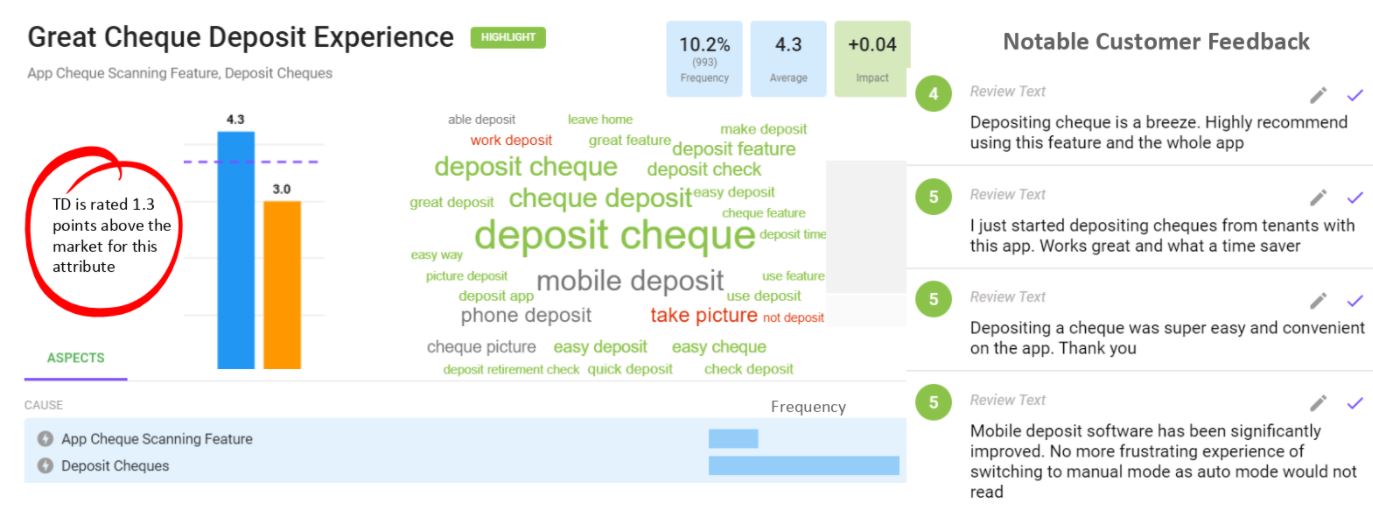

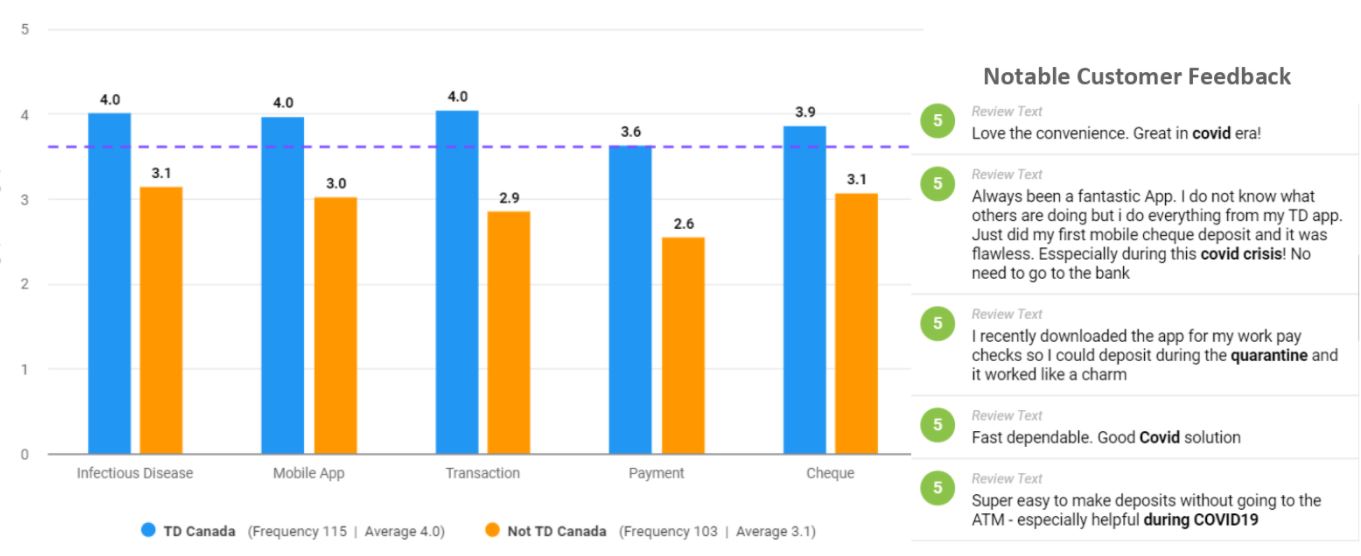

Novantas found that the TD Bank app is rated consistently higher than the market average for topics under usability, customer focus, and banking experience. Using Ipiphany to read and categorise customer comments allowed for an exploration of the specific aspects that contributed to higher-than-average scores, giving TD Bank a clear picture of just what it was that customers enjoyed about using their app. The key topics that Novantas investigated included the process of depositing cheques through the app, the speed at which bugs and issues were addressed and resolved, and their preparedness with regards to the shift to digital banking forced by the COVID-19 lockdowns.

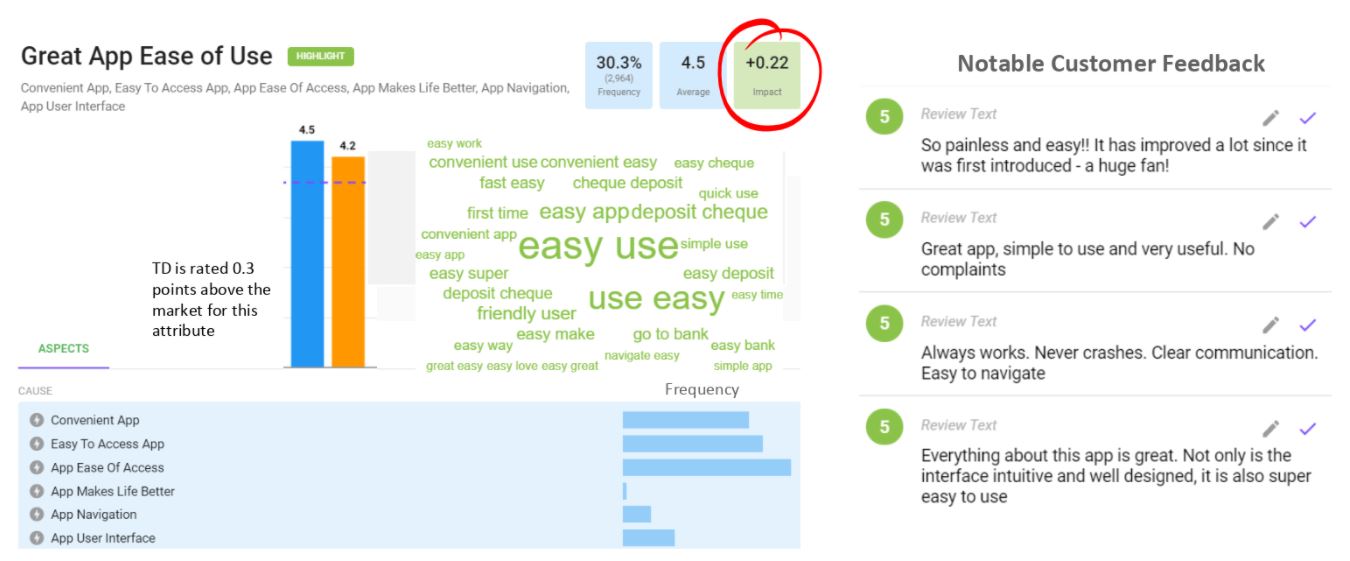

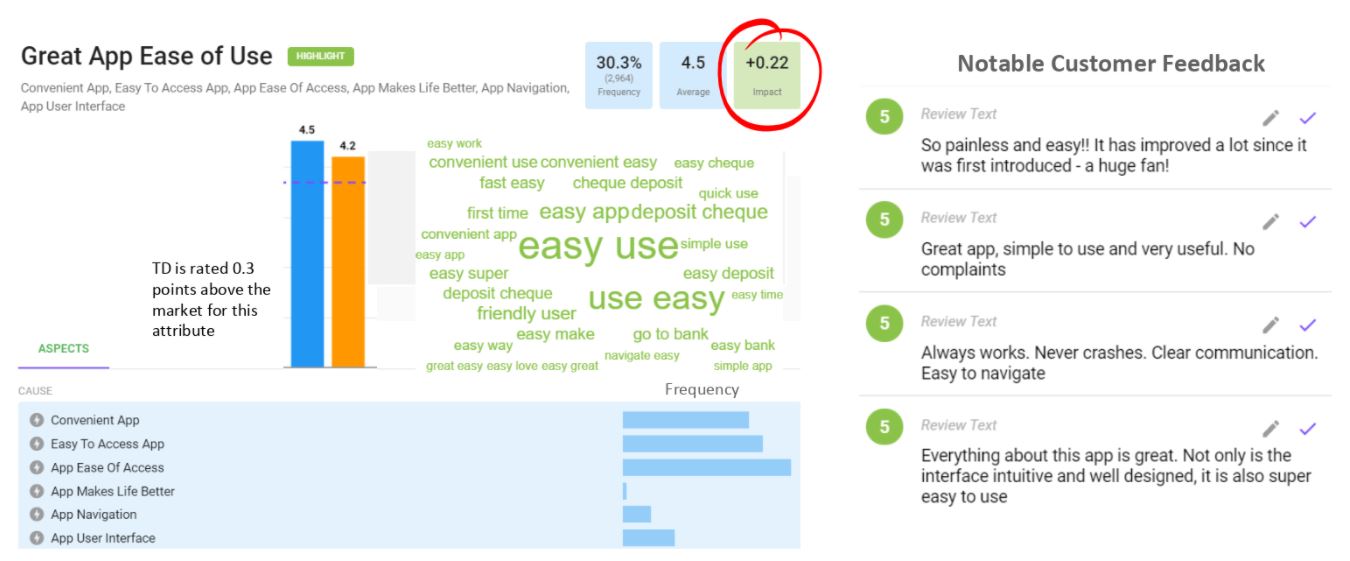

Identifying the reason behind the score

Delving down into the detail behind one of these topics - ‘app ease of use’, Ipiphany is able to help TD bank understand what exactly customers mean when they discuss this aspect. From Ipiphany’s detailed breakdown of concepts in the unstructured data, we find customers calling the app convenient, discussing the ease of their first time using it, and point out specific features of the app that are easy to use, like the cheque deposit feature. This has a positive impact of .22 on the overall score - quite significant.

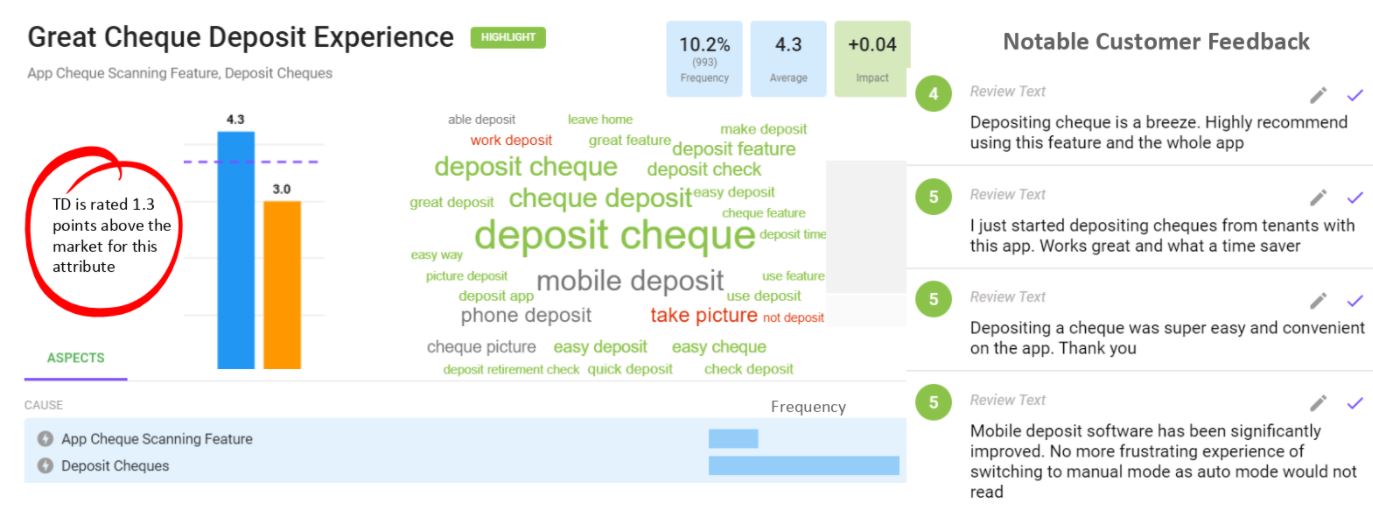

Taking one step further down, we find that customers discussing depositing cheques with the TD Bank app assign a score 1.3 points above the market average. Even though this functionality is widely adopted, TD Bank has made this process effortless and straightforward for their customers.

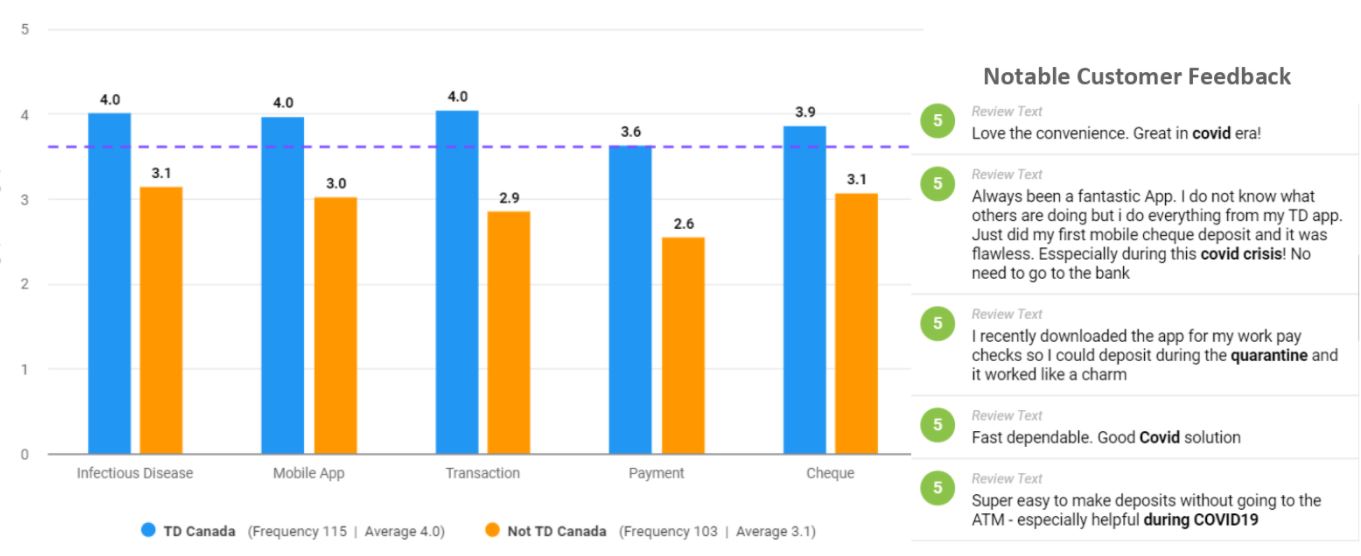

Overcoming pressure to go digital during COVID-19 lockdowns

It is clear from TD Bank’s customer feedback leading up to the COVID-19 lockdowns that they were well positioned to help their customers switch to digital banking as the need arose. As they already had a system in place to listen to and act on customer feedback, they were able to perform significantly better during the COVID lockdown period, .7 points higher in the US and .9 points higher in Canada.

While it’s impossible to plan or account for every world-altering event that may impact a business, the importance of implementing a customer-focused system with an agile response approach cannot be understated as a determining factor of success under pressure.

TD maintains best in breed status with a customer-first focus

“We’ve seen a significant increase in digital adoption as customers evolved how they transact during the pandemic. Our strong digital foundation has allowed us to continue to help support our customers as their needs evolve and also enabled us to create new ways to help them bank safely from home during the pandemic.” says Rizwan Khalfan, Chief Digital and Payments officer at TD.

With this exponential growth of digital channels fueled by the COVID-19 pandemic, a responsive and data-driven approach to continuous improvement has become even more important. Measuring and understanding feedback from engaged customers is paramount to enabling success in future-focused organisations, as TD Bank proves in both the Canadian and US markets. To learn more about TD Bank’s continuing success, read the press release here. To understand how analysing public reviews can reveal detailed insights about your business and customers, get a demo with one of our experts.